We thought our previous posting on why there's any spark in US real estate was going to be our final posting of the week.

Then we find out during the very late evening of a 19th 'make or break' Euro summit to save the rotten union, that Germany basically goes back on all its core principles at the last moment and caves to Spain and Italy:

"Euro zone officials have agreed to lend bailout funds directly to struggling banks rather than through each nation's central bank. The move has the effect of taking the governments of Italy and Spain off the hook for their beleaguered financial institutions by reducing their debt obligations. The plan also solidifies the unity of the Euro Zone at a moment when many questioned its survival.

The deal represents a meaningful concession by Germany which had previously refused to take on the additional risk of lending to the institutions directly and as a collective. The loans would be made via the €500b European Stability Mechanism (ESM) upon the formation of a European Central Bank (ECB) supervisory body." (Yahoo!)

Of course the markets were overjoyed.. Dow is +238 as of 3:20p..

Of course like all fake "rallies", we are 100% certain this one will be quite brief and you will see a nice -200+ pt drop sometime next week when those vermin who make their living investing realize that absolutely nothing was accomplished except to kick the can another few weeks.. maybe.

We could take the time to explain all the reasons why this is so, but its Friday afternoon, the sun is shining and all that... So instead, we'll repost a very astute and accurate analysis of the truth of yesterday's canard which was the 19th EU summit care of Phoenix Capital...

Some of the terminology and jargon may be confusing or unfamiliar, especially if you're a casual reader/follower of economics and global finance. Don't let that scare you off.. Focus on the bigger picture and skim wherever you need to. Afterwards, you'll understand why the Eurozone is 'toast' and why investors who are excited by last night's news are utter morons.

*The rest of this posting are excerpts from Phoenix Capital, not us. Any underlined or text in bold was originally chosen by the original author. However, to break up the piece as to be easier to read and follow, we added the pictures of tropical fish...

Have a good weekend... and keep your Euros next to your passports.

"Everyone in the media is viewing the latest announcements out of the EU Summit as game-changers.

They are not.

One facet of the deal is that ESM/ EFSF (European Stability Mechanism/ European Financial Stability Funds) loans to troubled countries will not subordinate private bondholders holdings.

While this does serve the purpose of allowing private bondholders to feel that should a country default, they might get their money back sooner (as opposed to what happened in Greece)… it doesn’t change the more critical issue of stopping defaults from happening...

None of the measures address the most critical issue pertaining to Europe: where is the money going to come from?

The European Stability Mechanism, which everyone sees as the ultimate savior for the EU, does NOT exist yet. Only four out of the required 17 countries have ratified its legislation.

And the due date for ratification? July 9th.

So we have less than two weeks for 14 EU members to ratify the ESM.

Another interesting fact about the ESM… Spain and Italy will contribute 30% of its funding. So… the mega-bailout fund which is going to save Spain and Italy is receiving nearly one third of its funds from the very same countries it’s going to bail out!?!

You couldn’t make this stuff up if you tried.

Another topic worth discussing is the fact that EU leaders didn’t agree to increase the EFSF or the ESM. The simple and obvious reason for this is no one has the funds to do this.

No one seems to be listening: Europe is out of buyers. End of story. There simply isn’t €500 billion lying around to be put to use. That’s why the ESM and EFSF aren’t being increased in size. They couldn’t be...

Oh, and none of this will go into effect until December. Let’s hope Spain and Italy and others don’t need the funds before then!

The benefits of the announcements (lower yields on sovereign bonds and higher share prices in EU banks) will be short-lived.

None of these decisions address the core issues facing the EU banking system: namely, insolvency and excessive leverage.

No one in the EU actually has the money to make these measures work (again, Spain and Italy will provide 30% of the ESM’s funding).

Markets will stage a knee jerk reaction to these measures. That reaction will see bank shares rise and yields fall, temporarily. But this move will be short-lived... After all, these announcements are just more political measures than anything else. And Europe needs capital NOT politics at this point...

EU leaders may have put off the Crisis by a few weeks (or perhaps even a month). But they still haven’t addressed the core issues causing the Crisis: excess leverage courtesy of hundreds of billions of Euros’ worth of garbage debt."

Friday, June 29, 2012

Thursday, June 28, 2012

The REAL reason for improved Real Estate

The corporate media... ugh.. What can we say about them but just.. Ugh!

Their relentless non-stop 24/7 pursuit to push the lies of economic optimism and 'recovery' would almost be admirable if not for the fact it is so harmful and dangerous.

We discovered this nonsense from NY Times today:

After Years of False Hopes, Signs of a Turn in Housing -- "After several years of false hopes, evidence is accumulating that the optimists may finally be right. The housing market is starting to recover. Prices are rising. Sales are increasing. Home builders are clearing lots and raising frames."

And the sun is shining, the birds are chirping, the cows in the meadows are 'moooo-ing' and flowers are in full bloom in all directions, as far as the eye can see....

Ugh! is right..

The rest of the NY Times article actually is more dreary in tone about housing than the exaggerative headline and opening paragraph suggested.

Still, let's say the Times article is 100% correct (which it isn't)... Why would there be a positive turn in housing? Is it that more people are now able to secure adequate lending? Or are good paying jobs springing up in abundance to allow people the means to pay their mortgages?

Maybe...

OK, actually No, not at all..

If housing is recovering (which its not), its more to do with this...

Overseas buyers seek shelter in U.S. real estate -- "Buyers from all over the world are snapping up U.S. real estate the way prospective brides yanked discount wedding gowns off the racks at those Filene’s Basement sales of yore.

Yes, some of the buyers are the super rich, like the Russian billionaire who allegedly bought an $88-million New York penthouse for his daughter. But others — upper-middle-class professionals and small business owners — are scooping up condos, townhouses and single-family homes. They’re buying in suburbs as well as cities. Nearly 40% are using their new homes as primary residences..." (MarketWatch)

That's interesting isn't it? Gotta love how much the US dollar has devalued vs other currencies.. Thanks Fed.

And so, who is buying up American homes?

"Canadians were by far the most frequent buyers, representing one out of every four dollars of international real estate purchased. Chinese nationals, Mexicans, Brits and Indians followed... most of them pay cold, hard cash."

~ The United States... 11th Province of Canada

How nice for them... And why would international vultures.. ~cough... um, I mean people seek ownership of American homes?

"U.S. real estate can be a great investment for foreign nationals. The real estate crash that began several years ago has produced some extraordinary bargains... International buyers view the U.S. as a safe haven for their money, governed by the rule of law and respect for property rights. Nearly a third of foreign purchasers viewed U.S. real estate as a “secure investment.” "

That's lovely.. Nice to see others benefiting and profiting off US misery with the full blessing of US leaders who actively encourage it.

Of course the ability of Americans to buy homes is not improved upon but who cares right? As long as the real estate market is improving.. By any means necessary, yes?

Yep everything is super.. why, look at South Florida for instance... real exciting what's happening there...

Brazilians snap up South Florida real estate sparking new boom -- "Waves of wealthy Brazilians are landing on South Florida’s shores and spending millions of dollars on vacation condominiums, clothes, furniture, cars and art, all of which are much less expensive here than in their homeland...

A Miami real estate broker said, "The dollar exchange rate now is very good for the Brazilians, so now is the time to buy. And on top of that, the prices of the properties, they went down big time, about 50 percent. It's a big discount.” (CNBC)

Ahh yes.. gotta love a dramatic discount on housing that only non-Americans can benefit from?

~ Is the Brazilian volleyball player passing secret plays to her teammates or secretly middle-fingering America? We'll get back to you...

"The economic impact would be even greater, say local economists, if Brazilians, like Europeans, could come and go using only passports rather than wading through the red tape of applying for tourist visas. In recognition of this obstacle, President Obama recently discussed the subject with Brazil’s President Dilma Rousseff during her first official visit to the White House"

Funny how the NY Times never made mention Once of this trend as to why real estate is improving. The assumption is American buyers purchasing homes from American sellers, and the real estate market finally on the way to prosperity and happiness for all..

Let's be honest, how can anyone celebrate or root for a US "recovery" that is mainly for the benefit of the very wealthy and for non-Americans?

When foreigners are buying up US homes because they are dirt cheap and make super investment opportunities i.e. foreign house 'flippers' while Americans are denied mortgages, how do we benefit?

When US corporations' profits go up while maintaining a skeleton work force of employees mixed with disposable temps, how do we benefit?

When the stock market goes up and up based on outright direct manipulation and rigging by the Fed while it creates inflation i.e. overall rise in cost of food, fuel, clothing, etc, how do we benefit?

How do WE Benefit??!!

We don't... yet the media pushes the lie that we do.

Its a new world we're living in.. one where realistic optimism is replaced by manufactured, contrived positivism; a world where the "haves" shred any pretense of empathy for the "have-nots"

The mindset is simple: There's going to be an American "recovery" and we're all going to celebrate it dammit!! And its going to happen because of Americans' standard of livin improving OR in spite of it!

Their relentless non-stop 24/7 pursuit to push the lies of economic optimism and 'recovery' would almost be admirable if not for the fact it is so harmful and dangerous.

We discovered this nonsense from NY Times today:

After Years of False Hopes, Signs of a Turn in Housing -- "After several years of false hopes, evidence is accumulating that the optimists may finally be right. The housing market is starting to recover. Prices are rising. Sales are increasing. Home builders are clearing lots and raising frames."

And the sun is shining, the birds are chirping, the cows in the meadows are 'moooo-ing' and flowers are in full bloom in all directions, as far as the eye can see....

Ugh! is right..

The rest of the NY Times article actually is more dreary in tone about housing than the exaggerative headline and opening paragraph suggested.

Still, let's say the Times article is 100% correct (which it isn't)... Why would there be a positive turn in housing? Is it that more people are now able to secure adequate lending? Or are good paying jobs springing up in abundance to allow people the means to pay their mortgages?

Maybe...

OK, actually No, not at all..

If housing is recovering (which its not), its more to do with this...

Overseas buyers seek shelter in U.S. real estate -- "Buyers from all over the world are snapping up U.S. real estate the way prospective brides yanked discount wedding gowns off the racks at those Filene’s Basement sales of yore.

Yes, some of the buyers are the super rich, like the Russian billionaire who allegedly bought an $88-million New York penthouse for his daughter. But others — upper-middle-class professionals and small business owners — are scooping up condos, townhouses and single-family homes. They’re buying in suburbs as well as cities. Nearly 40% are using their new homes as primary residences..." (MarketWatch)

That's interesting isn't it? Gotta love how much the US dollar has devalued vs other currencies.. Thanks Fed.

And so, who is buying up American homes?

"Canadians were by far the most frequent buyers, representing one out of every four dollars of international real estate purchased. Chinese nationals, Mexicans, Brits and Indians followed... most of them pay cold, hard cash."

~ The United States... 11th Province of Canada

How nice for them... And why would international vultures.. ~cough... um, I mean people seek ownership of American homes?

"U.S. real estate can be a great investment for foreign nationals. The real estate crash that began several years ago has produced some extraordinary bargains... International buyers view the U.S. as a safe haven for their money, governed by the rule of law and respect for property rights. Nearly a third of foreign purchasers viewed U.S. real estate as a “secure investment.” "

That's lovely.. Nice to see others benefiting and profiting off US misery with the full blessing of US leaders who actively encourage it.

Of course the ability of Americans to buy homes is not improved upon but who cares right? As long as the real estate market is improving.. By any means necessary, yes?

Yep everything is super.. why, look at South Florida for instance... real exciting what's happening there...

Brazilians snap up South Florida real estate sparking new boom -- "Waves of wealthy Brazilians are landing on South Florida’s shores and spending millions of dollars on vacation condominiums, clothes, furniture, cars and art, all of which are much less expensive here than in their homeland...

A Miami real estate broker said, "The dollar exchange rate now is very good for the Brazilians, so now is the time to buy. And on top of that, the prices of the properties, they went down big time, about 50 percent. It's a big discount.” (CNBC)

Ahh yes.. gotta love a dramatic discount on housing that only non-Americans can benefit from?

~ Is the Brazilian volleyball player passing secret plays to her teammates or secretly middle-fingering America? We'll get back to you...

"The economic impact would be even greater, say local economists, if Brazilians, like Europeans, could come and go using only passports rather than wading through the red tape of applying for tourist visas. In recognition of this obstacle, President Obama recently discussed the subject with Brazil’s President Dilma Rousseff during her first official visit to the White House"

Funny how the NY Times never made mention Once of this trend as to why real estate is improving. The assumption is American buyers purchasing homes from American sellers, and the real estate market finally on the way to prosperity and happiness for all..

Let's be honest, how can anyone celebrate or root for a US "recovery" that is mainly for the benefit of the very wealthy and for non-Americans?

When foreigners are buying up US homes because they are dirt cheap and make super investment opportunities i.e. foreign house 'flippers' while Americans are denied mortgages, how do we benefit?

When US corporations' profits go up while maintaining a skeleton work force of employees mixed with disposable temps, how do we benefit?

When the stock market goes up and up based on outright direct manipulation and rigging by the Fed while it creates inflation i.e. overall rise in cost of food, fuel, clothing, etc, how do we benefit?

How do WE Benefit??!!

We don't... yet the media pushes the lie that we do.

The mindset is simple: There's going to be an American "recovery" and we're all going to celebrate it dammit!! And its going to happen because of Americans' standard of livin improving OR in spite of it!

The Wealthy "Must" Know More than Others...

Whether its right or wrong, smart or stupid, when it comes to economics and finance, people respect the thoughts and opinions of the wealthy. The assumption of course is that they must know what they're talking about since its obviously how they acquired the wealth.

If your net worth isn't in the millions, everyday people don't value the advice you provide, just like if your net worth isn't in the hundreds of millions or billions, CNBC doesn't drool over you.

We tend to forget factors for wealth accumulation that have nothing to do with business brilliance such as inheritance, hiring others to manage money, shady unethical (and sometimes illegal) business deals, and of course, good old fashioned plain dumb luck...

So with that said, we understand that unless we display gaudy bank statements, most who read this site will take what we say about the US economy and Europe & Eurozone with grains of salt even if we're 100% correct most of the time.

That's fair enough. We only inform.. we can't make you believe.

So let's see what the 'brilliant' and 'superior' wealthy think..

~ C. Montgomery Burns mixed with deceased Apple CEO Steve Jobs.. Wow, talk about Double Pure Fucking EVIL! ~ Shudders.. Grins..

"If you want proof that the world's wealthy are worried, consider this: Swiss banking clients have nearly a third of their portfolio in cash. And one in five believe the Euro will collapse. The findings are included in a new report from LGT Group, the Austrian banking company, conducted with Austria's Johannes Kepler University...

In Switzerland, 58 percent of private banking clients have lost confidence in the financial system... Fully 22 percent expect the euro zone to collapse. The number was the same for Austrian clients... (they) are reducing their diversification strategies and retreating to gold and cash..." -- CNBC

Interesting..

And what do those super-brainy economists think? Sure they got the 2008 all wrong and have been minimizing the carnage at every step of the global recession/depression but since 'everyone' respects their opinions... what is their view of the survival of the Euro?

"Nearly half of the 22 economists surveyed by CNNMoney expect at least one country to pull out of the eurozone, and most of them think two to four countries will leave. One respondent is forecasting five to seven departures.

The economists also believe that the eurozone crisis will reach far beyond the European borders. Half said that Europe's problems are the most serious threat to the U.S. economy.

None of the economists predict there will be a complete breakup of the euro, as all of them said that the majority of EU residents will remain on the common currency." (CNN/Money)

Once again.. Interesting

In 2010, economists surveyed predicted the EU would fracture within 5 years and one economist specifically said about Greece that it "will certainly default on its debts, and it is an open question whether Greece will experience some form of revolution or coup" (Telegraph UK 6/5/10)

Looks like the economists still have three years to be proven correct... of course we at A&G believe this all will occur within the next 1-4 months.. so we'll see.

The important things are this:

1) If you live in Europe, even in a nation not directly affected by the problems of the Eurozone, have cash handy.. Keeping it in a bank will do little good if/when things quickly deteriorate. And remember there are no parties or celebrations that occur with a bank "holiday" -- you simply can not access your money.

2) If you live in the US or other parts of the world, you are not immune. Buffered to an extent, yes. But immune, no. It never hurts to keep cash with you can have quick & easy access.

3) When it comes to what will happen next with the EU or specific nations in it... or the global economy, no one really knows anything. They assume.. they guess.. they hope..

Life is fragile.. one day at a time. Modern finance is no different.

If your net worth isn't in the millions, everyday people don't value the advice you provide, just like if your net worth isn't in the hundreds of millions or billions, CNBC doesn't drool over you.

We tend to forget factors for wealth accumulation that have nothing to do with business brilliance such as inheritance, hiring others to manage money, shady unethical (and sometimes illegal) business deals, and of course, good old fashioned plain dumb luck...

So with that said, we understand that unless we display gaudy bank statements, most who read this site will take what we say about the US economy and Europe & Eurozone with grains of salt even if we're 100% correct most of the time.

That's fair enough. We only inform.. we can't make you believe.

So let's see what the 'brilliant' and 'superior' wealthy think..

~ C. Montgomery Burns mixed with deceased Apple CEO Steve Jobs.. Wow, talk about Double Pure Fucking EVIL! ~ Shudders.. Grins..

"If you want proof that the world's wealthy are worried, consider this: Swiss banking clients have nearly a third of their portfolio in cash. And one in five believe the Euro will collapse. The findings are included in a new report from LGT Group, the Austrian banking company, conducted with Austria's Johannes Kepler University...

In Switzerland, 58 percent of private banking clients have lost confidence in the financial system... Fully 22 percent expect the euro zone to collapse. The number was the same for Austrian clients... (they) are reducing their diversification strategies and retreating to gold and cash..." -- CNBC

Interesting..

And what do those super-brainy economists think? Sure they got the 2008 all wrong and have been minimizing the carnage at every step of the global recession/depression but since 'everyone' respects their opinions... what is their view of the survival of the Euro?

"Nearly half of the 22 economists surveyed by CNNMoney expect at least one country to pull out of the eurozone, and most of them think two to four countries will leave. One respondent is forecasting five to seven departures.

The economists also believe that the eurozone crisis will reach far beyond the European borders. Half said that Europe's problems are the most serious threat to the U.S. economy.

None of the economists predict there will be a complete breakup of the euro, as all of them said that the majority of EU residents will remain on the common currency." (CNN/Money)

Once again.. Interesting

In 2010, economists surveyed predicted the EU would fracture within 5 years and one economist specifically said about Greece that it "will certainly default on its debts, and it is an open question whether Greece will experience some form of revolution or coup" (Telegraph UK 6/5/10)

Looks like the economists still have three years to be proven correct... of course we at A&G believe this all will occur within the next 1-4 months.. so we'll see.

The important things are this:

1) If you live in Europe, even in a nation not directly affected by the problems of the Eurozone, have cash handy.. Keeping it in a bank will do little good if/when things quickly deteriorate. And remember there are no parties or celebrations that occur with a bank "holiday" -- you simply can not access your money.

2) If you live in the US or other parts of the world, you are not immune. Buffered to an extent, yes. But immune, no. It never hurts to keep cash with you can have quick & easy access.

3) When it comes to what will happen next with the EU or specific nations in it... or the global economy, no one really knows anything. They assume.. they guess.. they hope..

Life is fragile.. one day at a time. Modern finance is no different.

Nuggets about Gold

Yesterday's stock market (6/27) saw gold close at $1,574/oz

Do you know how much weight 1 oz is? Simply place 3 Oreo cookies in the palm of your hand... that's how much 1 oz weighs...

Do you know when was the first time gold reached $1,000?

Was it 1918? Perhaps 1931? Or maybe 1945.. or 1963.. or 1991...

Nope.

The first time in US history gold traded at over $1000 an ounce was in 2008... Specifically, March 12, 2008.

Wonder what the economic climate was at the time, especially since after all this was still pre-Lehman Brothers?

"Gold prices touched the $1,000 milestone for the first time Thursday (3/12/08) as the dollar plunged amid nagging fears about the health of the U.S. economy." -- CNN/Money

The US was in a recession back then.. Wait, correction-- the US is Still in a recession. Its just that in March 2008, people admitted it..

Here's a funny-smug comment in that CNN article about gold and the US economy -- "When the economy ends its current downturn, gold prices should eventually fall, as they did 28 years ago. After hitting the $847 mark in January 1980, gold futures fell 70% to $253 in August 1999."

Interesting information in that little paragraph..

1) Notice how cocksure the mainstream media was that the recession would end quickly and implication that those who owned gold were fools ("gold prices should eventually fall")?

Well the economic downturn hasn't stopped and gold has not dropped

2) In a little less than nine years, from August 1999 to March 2008, the value of Gold rose $747 per oz (approximately 400%)

What happened back in 1999 to cause such a drop in gold?

Oh yes.. the Dot.com bubble was still expanding. Everyone was rushing to put their precious $$ into every internet start up they could find. Then it went 'Poppp!' and the stock market valuations have really yet to recover from it, which is why the Fed intentionally pushed the post 9/11 housing bubble, and now the QE/liquidity bubble.

~ Talk about an expensive skin peel!

Here's another little piece of interesting information from the article:

"The $847 level in 1980 would be worth $2,170 in today's money, more than double the current price of gold"

This one sentence written over four years ago goes to the very heart of the money devaluation we're all experiencing and few truly noticing thanks to central bank policy. (think of a lobster slowly boiled in a pot)

Someone in 1980 could have bought a little over 2oz of gold for the same amount of money in terms of purchasing power as what someone would need to buy 1oz in 2008.

The purchasing power of the US dollar has declined 50% in 28 years. And most really never noticed or paid attention because what was the economic buffer of this and of stagnant wages, was the explosion of accessibility of personal credit.

But gold, like any publicly traded commodity goes up and down, even in time of economic misfortune. Last July, gold was valued around $1757/oz.

So why the drop in value by about $200/oz in the last 12 months?

The answer is found in the video we presented in our last posting. Investors want certainty and right now the only certainties for investing are assets that are implicitly and explicitly guaranteed by central banks i.e. the Fed.

In other words, if the price of gold, oil or soybeans drops precipitously, there will be no government intervention to back stop that plunge to protect investors. Market forces are still alive there and if you lose $, you're on your own.

With stocks, if it drops too quickly or too deeply, the Fed will virtually guarantee pumping more liquidity via QE, "Operation Twist" or other manipulative scheme to protect investors so they financially suffer... That is until something happens in the world to trigger a panic sell; a "black swan" event.

* 'Black swan' -- A metaphor that describes an event that is a surprise (to the observer), has a major impact, and after the fact is often inapproprately rationalized with the benefit of hindsight.

And when that happens, gold will skyrocket.

We don't advise you to buy or sell gold. We're not financial advisors and we do not profit or benefit from one decision or another. Everything in life has its plusses and minuses-- gold ownership is no different. Be Smart.

There are two current economic truths to remember: the worse the global economy gets, the lower the interest rates and the higher the price gold trades at.

Do you know how much weight 1 oz is? Simply place 3 Oreo cookies in the palm of your hand... that's how much 1 oz weighs...

Do you know when was the first time gold reached $1,000?

Was it 1918? Perhaps 1931? Or maybe 1945.. or 1963.. or 1991...

Nope.

The first time in US history gold traded at over $1000 an ounce was in 2008... Specifically, March 12, 2008.

Wonder what the economic climate was at the time, especially since after all this was still pre-Lehman Brothers?

"Gold prices touched the $1,000 milestone for the first time Thursday (3/12/08) as the dollar plunged amid nagging fears about the health of the U.S. economy." -- CNN/Money

The US was in a recession back then.. Wait, correction-- the US is Still in a recession. Its just that in March 2008, people admitted it..

Here's a funny-smug comment in that CNN article about gold and the US economy -- "When the economy ends its current downturn, gold prices should eventually fall, as they did 28 years ago. After hitting the $847 mark in January 1980, gold futures fell 70% to $253 in August 1999."

Interesting information in that little paragraph..

1) Notice how cocksure the mainstream media was that the recession would end quickly and implication that those who owned gold were fools ("gold prices should eventually fall")?

Well the economic downturn hasn't stopped and gold has not dropped

2) In a little less than nine years, from August 1999 to March 2008, the value of Gold rose $747 per oz (approximately 400%)

What happened back in 1999 to cause such a drop in gold?

Oh yes.. the Dot.com bubble was still expanding. Everyone was rushing to put their precious $$ into every internet start up they could find. Then it went 'Poppp!' and the stock market valuations have really yet to recover from it, which is why the Fed intentionally pushed the post 9/11 housing bubble, and now the QE/liquidity bubble.

~ Talk about an expensive skin peel!

Here's another little piece of interesting information from the article:

"The $847 level in 1980 would be worth $2,170 in today's money, more than double the current price of gold"

This one sentence written over four years ago goes to the very heart of the money devaluation we're all experiencing and few truly noticing thanks to central bank policy. (think of a lobster slowly boiled in a pot)

Someone in 1980 could have bought a little over 2oz of gold for the same amount of money in terms of purchasing power as what someone would need to buy 1oz in 2008.

The purchasing power of the US dollar has declined 50% in 28 years. And most really never noticed or paid attention because what was the economic buffer of this and of stagnant wages, was the explosion of accessibility of personal credit.

But gold, like any publicly traded commodity goes up and down, even in time of economic misfortune. Last July, gold was valued around $1757/oz.

So why the drop in value by about $200/oz in the last 12 months?

The answer is found in the video we presented in our last posting. Investors want certainty and right now the only certainties for investing are assets that are implicitly and explicitly guaranteed by central banks i.e. the Fed.

In other words, if the price of gold, oil or soybeans drops precipitously, there will be no government intervention to back stop that plunge to protect investors. Market forces are still alive there and if you lose $, you're on your own.

With stocks, if it drops too quickly or too deeply, the Fed will virtually guarantee pumping more liquidity via QE, "Operation Twist" or other manipulative scheme to protect investors so they financially suffer... That is until something happens in the world to trigger a panic sell; a "black swan" event.

* 'Black swan' -- A metaphor that describes an event that is a surprise (to the observer), has a major impact, and after the fact is often inapproprately rationalized with the benefit of hindsight.

And when that happens, gold will skyrocket.

We don't advise you to buy or sell gold. We're not financial advisors and we do not profit or benefit from one decision or another. Everything in life has its plusses and minuses-- gold ownership is no different. Be Smart.

There are two current economic truths to remember: the worse the global economy gets, the lower the interest rates and the higher the price gold trades at.

Tuesday, June 26, 2012

Video: CNBC- "We All Live & Die by Central Banks"

Interesting video from CNBC... quite honest actually.

The host & guests acknowledge that the entire stock market is based on rumor, innuendo and the whim & will of central planners like the Fed. They also admit the US economy is pretty much stuck in mud, if not for the intervention it would be much worse...

But since CNBC is aimed specifically at Investors, this is what's called talking 'shop' or "inside baseball". If CNBC's programmin was aimed at everyday people, none of information in this 4 min video would be uttered by any of the guests because it would be too dangerous..

People seem to need to believe our economy is doing well, that we're still a sovereign nation and that we live in a capitalistic society which drives how markets react and behave.

Video is 4min long (to mute music, click at very bottom left of the page)

The host & guests acknowledge that the entire stock market is based on rumor, innuendo and the whim & will of central planners like the Fed. They also admit the US economy is pretty much stuck in mud, if not for the intervention it would be much worse...

But since CNBC is aimed specifically at Investors, this is what's called talking 'shop' or "inside baseball". If CNBC's programmin was aimed at everyday people, none of information in this 4 min video would be uttered by any of the guests because it would be too dangerous..

People seem to need to believe our economy is doing well, that we're still a sovereign nation and that we live in a capitalistic society which drives how markets react and behave.

Video is 4min long (to mute music, click at very bottom left of the page)

Photos: $10k homes for sale

Yesterday we showed what real estate is like in Camden, NJ as a means to reiterate a point we've made often that beyond the overall health or sickness of the national economy, when a city's economy deteriorates, it brings down everything including property values to the point that many wouldn't live in such homes if given away for free.

Today we decided to be a little more positive and upbeat.. kinda sorta..

We wondered what type of homes, if any were available to purchase if a buyer only wished to spend $10k. To give perspective to that sum of money, there is not a single brand new 2012 automobile you can buy for under $10k before taxes unless it was a stick shift (manual transmission) and devoid of everything short of a seat and a steering wheel.

We used the Remax real estate website (we could have used any major site but that was the first we chose) and though we could have picked any city in the US to do this experiment, we selected Detroit.

Honestly, for $10k, we expected if anything, to find some real horrible homes covered with graffiti with boarded up doors and windows, overgrown grass and such..

We we surprised... we found some decent, livable homes for that price.

The reason is due to how genuinely horrible and depressed the real estate market is. These are called 'short sales'. The banks are desperate to rid themselves of ownership even if it means taking a loss.

And there's another factor to consider-- often in 'short sale' homes, the tenant is still occupied. That means when you do buy that home, the person living there will immediately be kicked out on the street... like dogs.

This does not happen in a real estate "Recovery".

As stated yesterday, we will provide basic information about the homes but not the street addresses for privacy purposes. All homes here are for sale as of today and if you're interested in buying something you see, that's up to you to take the time to research this on real estate sites on your own.

Remember, all the following homes listed for sale at $10k:

3 bedrooms, 1 bath -- "Beautiful brick bungalow with updates. Maintained condition in magnificent area. This property has a fire place, full basement, newer windows"

2 bedrooms, 1 bath -- "Finished Upper Bedroom, Bar in Basement, Plenty of Storage"

3 bedrooms, 2.5 bath -- "FEATURES INCLUDE: LG DECK ON UPPER FLOOR IN BACK OF HOUSE, FIRE PLACE IN LIV.ROOM, NEW CARPET IN SOME ROOMS, NEW ROOF, NEW ELECT. BOX, NEW PLUMBING, 3 NEW SECURITY DOORS, FENCED YARD..."

2 Bedrooms, 1 Bath -- "BRICK BUNGALOW WITH FIREPLACE. WELL KEPT HOUSE" (photo taken last June & still for sale)

3 bedrooms, 2 baths -- "This BRICK home has TWO kitchens and TWO baths. The first floor kitchen has GRANITE counter tops. The basement is finished."

3 bedrooms, 1 bath -- "BEAUTIFUL FIREPLACE IN LIVING ROOM. PARTIALLY FINISHED BASEMENT COULD BE USED AS 4TH BEDROOM OR FAMILY ROOM. LOTS OF STORAGE SPACE LOCATED IN LOWER LEVEL."

When we searched the real estate website, we found 113 listings in Detroit... every home a short sale; every home listed for $10k.

We don't want to make it seem like magically all one needs is exactly $10k and the home is yours. There's usually back taxes to be paid and processing fees, etc. And once you do move in, undoubtedly there's going to be the need for some repairs and remodeling.

Nonetheless, you are getting a livable home for less than a brand new Kia or Subaru.. That is assuming the previous homeowners who've probably lived their whole lives before being kicked to the curb, don't get some revenge on your property on their way out the door.

Today we decided to be a little more positive and upbeat.. kinda sorta..

We wondered what type of homes, if any were available to purchase if a buyer only wished to spend $10k. To give perspective to that sum of money, there is not a single brand new 2012 automobile you can buy for under $10k before taxes unless it was a stick shift (manual transmission) and devoid of everything short of a seat and a steering wheel.

We used the Remax real estate website (we could have used any major site but that was the first we chose) and though we could have picked any city in the US to do this experiment, we selected Detroit.

Honestly, for $10k, we expected if anything, to find some real horrible homes covered with graffiti with boarded up doors and windows, overgrown grass and such..

We we surprised... we found some decent, livable homes for that price.

The reason is due to how genuinely horrible and depressed the real estate market is. These are called 'short sales'. The banks are desperate to rid themselves of ownership even if it means taking a loss.

And there's another factor to consider-- often in 'short sale' homes, the tenant is still occupied. That means when you do buy that home, the person living there will immediately be kicked out on the street... like dogs.

This does not happen in a real estate "Recovery".

As stated yesterday, we will provide basic information about the homes but not the street addresses for privacy purposes. All homes here are for sale as of today and if you're interested in buying something you see, that's up to you to take the time to research this on real estate sites on your own.

Remember, all the following homes listed for sale at $10k:

3 bedrooms, 1 bath -- "Beautiful brick bungalow with updates. Maintained condition in magnificent area. This property has a fire place, full basement, newer windows"

2 bedrooms, 1 bath -- "Finished Upper Bedroom, Bar in Basement, Plenty of Storage"

3 bedrooms, 2.5 bath -- "FEATURES INCLUDE: LG DECK ON UPPER FLOOR IN BACK OF HOUSE, FIRE PLACE IN LIV.ROOM, NEW CARPET IN SOME ROOMS, NEW ROOF, NEW ELECT. BOX, NEW PLUMBING, 3 NEW SECURITY DOORS, FENCED YARD..."

2 Bedrooms, 1 Bath -- "BRICK BUNGALOW WITH FIREPLACE. WELL KEPT HOUSE" (photo taken last June & still for sale)

3 bedrooms, 2 baths -- "This BRICK home has TWO kitchens and TWO baths. The first floor kitchen has GRANITE counter tops. The basement is finished."

3 bedrooms, 1 bath -- "BEAUTIFUL FIREPLACE IN LIVING ROOM. PARTIALLY FINISHED BASEMENT COULD BE USED AS 4TH BEDROOM OR FAMILY ROOM. LOTS OF STORAGE SPACE LOCATED IN LOWER LEVEL."

When we searched the real estate website, we found 113 listings in Detroit... every home a short sale; every home listed for $10k.

We don't want to make it seem like magically all one needs is exactly $10k and the home is yours. There's usually back taxes to be paid and processing fees, etc. And once you do move in, undoubtedly there's going to be the need for some repairs and remodeling.

Nonetheless, you are getting a livable home for less than a brand new Kia or Subaru.. That is assuming the previous homeowners who've probably lived their whole lives before being kicked to the curb, don't get some revenge on your property on their way out the door.

Monday, June 25, 2012

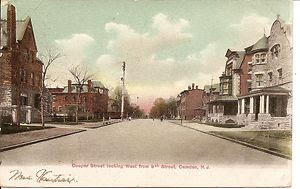

Photos: Camden, NJ Homes For Sale

The most popular posting A&G has done to date is where we show Camden NJ in pictures in the present vs how it was no more than 50 years prior. Literally thousands upon thousands of people have looked, marveled and ultimately reacted sickeningly to how dramatic the city has deteriorated.

http://ants-and-grasshoppers.blogspot.com/2011/02/photos-camden-nj-then-and-now.html

We also had gotten a very ignorant comment today on that post which motivated us to do this response.

We wanted to show you some homes that are currently for sale if you desired moving or relocating to Camden. We will provide the basic house information and asking price, but not the street address, for privacy reasons.

The information is real and currently provided by real estate websites. Also, you will notice many of the dates on the photos are from 2011; as of today 6/25/12, they are still on the market

Asking price: $35,000 3 bedroom, 1 bath; 1064 sq. ft.

Asking price: $34,900 3 bedroom, 1 bath; 1165 sq. ft.

Asking price: $37,500 3 bedroom, 1 bath; 1365 sq. ft.

Asking price: $39,000 2 bedroom, 1 bath; 880 sq. ft.

Asking price: $45,750 3 bedroom, 2 bath; 1296 sq. ft.

We also found some listings with rather absurdly high asking prices. We think the sellers are highly delusional or on drugs:

Asking price: $159,411 4 bedroom, 3 bath; 2044 sq. ft.

Asking price: $154,900 2 bedroom, 1 bath; 785 sq. ft.

Asking price: $149,90 2 bedroom, 2 bath; 984 sq. ft.

We end this posting with some postcards depicting Camden of years past, so you the reader can compare what Camden once was to what it is presently...

http://ants-and-grasshoppers.blogspot.com/2011/02/photos-camden-nj-then-and-now.html

We also had gotten a very ignorant comment today on that post which motivated us to do this response.

We wanted to show you some homes that are currently for sale if you desired moving or relocating to Camden. We will provide the basic house information and asking price, but not the street address, for privacy reasons.

The information is real and currently provided by real estate websites. Also, you will notice many of the dates on the photos are from 2011; as of today 6/25/12, they are still on the market

Asking price: $35,000 3 bedroom, 1 bath; 1064 sq. ft.

Asking price: $34,900 3 bedroom, 1 bath; 1165 sq. ft.

Asking price: $37,500 3 bedroom, 1 bath; 1365 sq. ft.

Asking price: $39,000 2 bedroom, 1 bath; 880 sq. ft.

Asking price: $45,750 3 bedroom, 2 bath; 1296 sq. ft.

We also found some listings with rather absurdly high asking prices. We think the sellers are highly delusional or on drugs:

Asking price: $159,411 4 bedroom, 3 bath; 2044 sq. ft.

Asking price: $154,900 2 bedroom, 1 bath; 785 sq. ft.

Asking price: $149,90 2 bedroom, 2 bath; 984 sq. ft.

We end this posting with some postcards depicting Camden of years past, so you the reader can compare what Camden once was to what it is presently...

Friday, June 22, 2012

Time capsule: 1988 Pres Debates

In a little more than four months, people (who can motivate themselves to do so) will be voting in the 2012 Presidential election. And while every election always seems to bring out the same emotions in people-- stale candidates, tired talking points, both owned by Wall St, etc.., elections are actually quite special & unique.

It is really the only time a President, or candidate to become President, will even pretend to care what an everyday person thinks or feels. Its pretty much the only time you ever see Elites bother to do everyday activities with the common folk like play horseshoes or order a slice of pecan pie at the local diner.

The best part about a Presidential election is its really the only opportunity to see politicians flustered or irritated and yet can't scurry out the back door or hide. This usually takes place during debates.

They have to stand there at the podium and take the political jabs and the more they fight back, the more people can see politicians for what they are... desperate base animals dressed in expensive suits.

Bush: "I'm going to crush you into dust, shorty"

Dukakis: "Just try it, you wimp"

Speaking of debates, for "fun" and mere curiosity one night while perusing through YouTube, yours truly watched a Presidential debate from September, 1988 between George H.W. Bush and Michael Dukakis who was Governor of Massachusetts at the time.

As all debates go, it was rather a lengthy, long winded affair but we thought it would be interesting to touch on some highlights of that debate to show just how much times have changed in 24 years and yet in some ways, nothing's changed at all.

Because this was a 90min debate, we will keep this as brief and to-the-point as relates to the present, as we possibly can.

For some historical perspective, we remind the reader that in 1988, we had yet to invade Iraq. Saddam Hussein would not invade Kuwait, which triggered the US intervention, until August 1990. In addition, there still was in existence the Soviet Union and the Berlin Wall.

The National Debt was under $3 Trillion (its over $15.8 Trillion today). The Dow would not top 2,800 for the first time until 1990.

~ Which pack of cigarettes will you be smoking to show your support?

* The 1988 debate began with the moderator asking a question: "The polls say the #1 issue concerning Americans domestically is drugs..." Wow.. Drugs. Wouldn't it be so nice if that was our #1 worry today?

Bush who was VP at the time, talked about the deterioration of values, the need for harsher criminal penalties and how the President needed to lead the Drug War by example... Good thing he didn't know his son, W was heavily drinking, smoking pot and doing coke at this time or Bush Sr. would have felt quite silly saying what he did..

* Afterwards, there's a back-n-forth between Dukakis and Bush about Panama's leader at the time Manuel Noriega. Bush seems irritated as he speaks. The specific points-counterpoints aren't important but when Bush becomes President, US forces invade Panama in 1989, forcibly removed Noriega and then arrested him.

* The next topic for debate is taxes and balancing budgets to try to lower the deficit. Bush proposed lowering income taxes to spur job growth. Dukakis said the tax cuts only benefits the top 1%. He also wanted to cut back on defense spending while Bush stated the importance of a ready military and blames Congress for excessive spending.

24 years later and there's no evolution of political thought.

Bush also reiterated a promise he would make repeatedly during the '88 Campaign.. under his Presidency there would be "No New Taxes!" He would backtrack on that pledge in 1991, blame it on Democrats 'backing him into a corner', and it would be the death knell of his election for a 2nd term in 1992.

* The next topic concerns medical coverage... the questioner states 31 million Americans (in 1988) have no health coverage. Bush started by saying "One thing I will not do is sock businesses..."

The two candidates give their talking points then the discussion switches to AIDS and funding for AZT which treats the disease. You certainly don't hear any politician of either party ever talk about AIDS or finding a cure today. Guess containment seems to be good enough.

* As the debate goes on, a question is posed to Bush as to why he keeps referring to Dukakis' affiliation the ACLU as "a card carrying member of..." .

Full of fluster and fury, Bush equated the ACLU with among other things, defending kiddie porn and wanting to taking away movie ratings so his 10yr old grandchild "sees X rated movies". Bush also defended the Catholic Church's right to tax exemption.

~ BTW, before we continue, we want to be clear that we are not attacking Bush because we agreed with Dukakis' positions or wish he had been elected President in 1988. Its simply that Dukakis' political views really don't matter. He didn't win so his thoughts and opinions never became public policy or affected anyone; they are irrelevant.

* The debate moves to housing. Dukakis wanted to provide more dwellings for people who are the poorest to live in. Bush wanted to push more home ownership and much lower interest rates. This would also be a guiding policy of Fed Chair Alan Greenspan who served during Reagan, Bush Sr. and Clinton's administrations.

At this point we'll stop the specific debate analysis... After all it is 2012, not 1988 and many of the topics debated like abortion, death penalty, education, responsibilities of Fed Govt vs private sector are quite honestly, very stale and the same talking points Dems & Reps utter today.

The point of all this was to give little glimpses back at a time that was full of problems which seem so trivial and in some ways, welcomed today compared with the issues we're dealing with.

The economy and unemployment was a mere afterthought. It was so unimportant an issue to voters that the debate moderator didn't even ask a question until 50 minutes into the 90 min debate.

We also were not involved in any wars, sending US men and women thousands of miles away to be put in harms' way daily for convoluted causes with undefined objectives. The worst we did back then was aid Nicaraguan Contras with money and weapons

~ SNL's Dana Carvey & Jon Lovitz spoofing the candidates

And Europe was not a real thought in any American's mind unless it was planning out an exciting family vacation destination. All the political and economic plate-shifting caused by the fall of Soviet Union would not occur until a year later.. 1989.

We wonder 24 years from now, when any bored souls take the time to watch the 2012 Presidential debates, will they see 2012 as our true bottom point; a time where things would not get worse, and thus began a progressive, steady climb to national and global happiness and prosperity?

Or to someone living in 2036, will 2012 be viewed as "a simpler time" or awful to imagine, "a better day"?

It is really the only time a President, or candidate to become President, will even pretend to care what an everyday person thinks or feels. Its pretty much the only time you ever see Elites bother to do everyday activities with the common folk like play horseshoes or order a slice of pecan pie at the local diner.

The best part about a Presidential election is its really the only opportunity to see politicians flustered or irritated and yet can't scurry out the back door or hide. This usually takes place during debates.

They have to stand there at the podium and take the political jabs and the more they fight back, the more people can see politicians for what they are... desperate base animals dressed in expensive suits.

Bush: "I'm going to crush you into dust, shorty"

Dukakis: "Just try it, you wimp"

Speaking of debates, for "fun" and mere curiosity one night while perusing through YouTube, yours truly watched a Presidential debate from September, 1988 between George H.W. Bush and Michael Dukakis who was Governor of Massachusetts at the time.

As all debates go, it was rather a lengthy, long winded affair but we thought it would be interesting to touch on some highlights of that debate to show just how much times have changed in 24 years and yet in some ways, nothing's changed at all.

Because this was a 90min debate, we will keep this as brief and to-the-point as relates to the present, as we possibly can.

For some historical perspective, we remind the reader that in 1988, we had yet to invade Iraq. Saddam Hussein would not invade Kuwait, which triggered the US intervention, until August 1990. In addition, there still was in existence the Soviet Union and the Berlin Wall.

The National Debt was under $3 Trillion (its over $15.8 Trillion today). The Dow would not top 2,800 for the first time until 1990.

~ Which pack of cigarettes will you be smoking to show your support?

* The 1988 debate began with the moderator asking a question: "The polls say the #1 issue concerning Americans domestically is drugs..." Wow.. Drugs. Wouldn't it be so nice if that was our #1 worry today?

Bush who was VP at the time, talked about the deterioration of values, the need for harsher criminal penalties and how the President needed to lead the Drug War by example... Good thing he didn't know his son, W was heavily drinking, smoking pot and doing coke at this time or Bush Sr. would have felt quite silly saying what he did..

* Afterwards, there's a back-n-forth between Dukakis and Bush about Panama's leader at the time Manuel Noriega. Bush seems irritated as he speaks. The specific points-counterpoints aren't important but when Bush becomes President, US forces invade Panama in 1989, forcibly removed Noriega and then arrested him.

* The next topic for debate is taxes and balancing budgets to try to lower the deficit. Bush proposed lowering income taxes to spur job growth. Dukakis said the tax cuts only benefits the top 1%. He also wanted to cut back on defense spending while Bush stated the importance of a ready military and blames Congress for excessive spending.

24 years later and there's no evolution of political thought.

Bush also reiterated a promise he would make repeatedly during the '88 Campaign.. under his Presidency there would be "No New Taxes!" He would backtrack on that pledge in 1991, blame it on Democrats 'backing him into a corner', and it would be the death knell of his election for a 2nd term in 1992.

* The next topic concerns medical coverage... the questioner states 31 million Americans (in 1988) have no health coverage. Bush started by saying "One thing I will not do is sock businesses..."

The two candidates give their talking points then the discussion switches to AIDS and funding for AZT which treats the disease. You certainly don't hear any politician of either party ever talk about AIDS or finding a cure today. Guess containment seems to be good enough.

* As the debate goes on, a question is posed to Bush as to why he keeps referring to Dukakis' affiliation the ACLU as "a card carrying member of..." .

Full of fluster and fury, Bush equated the ACLU with among other things, defending kiddie porn and wanting to taking away movie ratings so his 10yr old grandchild "sees X rated movies". Bush also defended the Catholic Church's right to tax exemption.

~ BTW, before we continue, we want to be clear that we are not attacking Bush because we agreed with Dukakis' positions or wish he had been elected President in 1988. Its simply that Dukakis' political views really don't matter. He didn't win so his thoughts and opinions never became public policy or affected anyone; they are irrelevant.

* The debate moves to housing. Dukakis wanted to provide more dwellings for people who are the poorest to live in. Bush wanted to push more home ownership and much lower interest rates. This would also be a guiding policy of Fed Chair Alan Greenspan who served during Reagan, Bush Sr. and Clinton's administrations.

At this point we'll stop the specific debate analysis... After all it is 2012, not 1988 and many of the topics debated like abortion, death penalty, education, responsibilities of Fed Govt vs private sector are quite honestly, very stale and the same talking points Dems & Reps utter today.

The point of all this was to give little glimpses back at a time that was full of problems which seem so trivial and in some ways, welcomed today compared with the issues we're dealing with.

The economy and unemployment was a mere afterthought. It was so unimportant an issue to voters that the debate moderator didn't even ask a question until 50 minutes into the 90 min debate.

We also were not involved in any wars, sending US men and women thousands of miles away to be put in harms' way daily for convoluted causes with undefined objectives. The worst we did back then was aid Nicaraguan Contras with money and weapons

~ SNL's Dana Carvey & Jon Lovitz spoofing the candidates

And Europe was not a real thought in any American's mind unless it was planning out an exciting family vacation destination. All the political and economic plate-shifting caused by the fall of Soviet Union would not occur until a year later.. 1989.

We wonder 24 years from now, when any bored souls take the time to watch the 2012 Presidential debates, will they see 2012 as our true bottom point; a time where things would not get worse, and thus began a progressive, steady climb to national and global happiness and prosperity?

Or to someone living in 2036, will 2012 be viewed as "a simpler time" or awful to imagine, "a better day"?

Thursday, June 21, 2012

Ducks, Bread and the Fed

We start today's posting with a true story from yours truly...

When I was little, I lived briefly in a very rural area. Not to the degree of a fully functioning farm but rural enough that there was a good space of land between us and any other neighbors with a waterway which was perfect for fishing for anyone who enjoyed that sort of thing.

And on the property, live a large family of ducks, perhaps between 15-20, all following the leader which was their 'Mama' or 'Papa' duck.

One day I decided I would go outside, loaf of bread under arm, and feed the ducks. It didn't take them long to notice me and to run quickly & clumsily toward every piece of bread I tossed. Sometimes I'd toss bread pieces directly at them; other times purposely away from them so I could have a little laugh watching them scurry about.

Other times I would jog around the property so the ducks would follow and chase after me, occasionally tossing bread pieces to make sure they continued following.

Over time this activity went in the ducks' minds from surprise to complete expectation. It got to a point where every time I would leave the house, the ducks would gather quickly about me for their next meal, and if I went back in, they'd linger by the door for long stretches making loud noises which got to be at times irritating.

~ "Hey Cat, Got any bread? Wakk Wakk"

There was one duck in particular (I referred to him as "Tuffy") who seemed to resent having to chase me about for the bread. The duck had serious attitude! So if I had no bread to give or I neglected him, he'd snip at my leg or literally use his beak to 'Bop!' into my ankle.

Tuffy duck was not going to be denied what he grew accustomed to receiving. He Wanted that bread... he Expected it... he let me know in his mind I was to serve him and be his provider.

And because of it, I stopped altogether.

Whenever I think about Wall St; about banks and Investors and the Federal Reserve, I always end up thinking about those ducks and how ultimately there's very little difference.

Last Thursday, Friday and this Tuesday the stock market saw triple digit gains on the expectation and demand that the Fed intervene and pump more liquidity into the markets. Didn't matter if the Fed used Greece or weak jobs or (fill in the rationale)--

So Bernanke provided the "Tuffy ducks" more 'bread'... they were pleased for a day and now realized they want more 'bread' than what was provided. They don't want little scraps of "Operation Twist" brand 'bread'.. They really want those large QE bread pieces fed to them.

And the 'ducks' (really they're rats) will make a big stink until its done.

~ "We're not going anywhere Cat.. Wakk Wakk.. Where's the bread?"

Today's actually a good day in the economy even though the financial media will portray it as doom and gloom. First, as of 3:30p, the Dow is down -230pts. We always celebrate a down day even if the reasons are as fake as eyelashes.

In addition, oil is trading under $80/barrel for the first time in many many months, which of course Investors hate. And the US dollar is gaining strength due to the Euro crisis, which Investors & Corporations Really Really Hate

But getting back to the duck/Investor comparison, what should be happening is the Fed, which holds the 'loaf of bread' under their arm, teach the banks and Investors a lesson in respect by doing absolutely nothing, and simply watch them desperately run in panic until they understand not to expect constant intervention and bailouts for the mess they created.

But like we've said often, the Federal Reserve is not a government agency. It is as private a business as Federal Express and its clients are the same banks and other financiers who manipulate the market to get their way. So expecting any change in policy is a pipe dream.

And expecting some other Fed Chair to come along and institute a different policy is a waste of time.

Most are unaware of this but when its time for the President to nominate a new Fed Chair, the list of choices is provided to him by the Fed. This is a big reason why so many Fed Chairs get re-nominated by Presidents of different political parties... the President looks at the list and thinks to himself, "What's the point?" and just re-nominates...

Here's another thing most do not understand.. there are two economies in America. The Wall St economy and the Real World economy. On occasion they blend to each other so success in corporate America "trickles down" to Main Street America but its rare.

If a Fortune 500 company's profits are up 25% or exporting more products abroad, it does not make your life any better unless you have investments with company X or work there, and even then your job isn't safe because you can always be fired as part of a 'restructuring'.

Most corporations don't create jobs anyways. They create positions.

What is the difference? Plenty. A position is an opening for a person to earn money in exchange for work provided. It can be minimum wage work, temp work, part-time work, etc.. Usually positions pay hourly wages and have little to no security.

Jobs are positions that pay a good wage; enough to allow someone to pay their bills and still have a little something left over. Jobs usually require education, provide benefits, allow the employee some rights and protections within the company and usually provide opportunities for future career advancement and/or promotion.

When I was little, I lived briefly in a very rural area. Not to the degree of a fully functioning farm but rural enough that there was a good space of land between us and any other neighbors with a waterway which was perfect for fishing for anyone who enjoyed that sort of thing.

And on the property, live a large family of ducks, perhaps between 15-20, all following the leader which was their 'Mama' or 'Papa' duck.

One day I decided I would go outside, loaf of bread under arm, and feed the ducks. It didn't take them long to notice me and to run quickly & clumsily toward every piece of bread I tossed. Sometimes I'd toss bread pieces directly at them; other times purposely away from them so I could have a little laugh watching them scurry about.

Other times I would jog around the property so the ducks would follow and chase after me, occasionally tossing bread pieces to make sure they continued following.

Over time this activity went in the ducks' minds from surprise to complete expectation. It got to a point where every time I would leave the house, the ducks would gather quickly about me for their next meal, and if I went back in, they'd linger by the door for long stretches making loud noises which got to be at times irritating.

~ "Hey Cat, Got any bread? Wakk Wakk"

There was one duck in particular (I referred to him as "Tuffy") who seemed to resent having to chase me about for the bread. The duck had serious attitude! So if I had no bread to give or I neglected him, he'd snip at my leg or literally use his beak to 'Bop!' into my ankle.

Tuffy duck was not going to be denied what he grew accustomed to receiving. He Wanted that bread... he Expected it... he let me know in his mind I was to serve him and be his provider.

And because of it, I stopped altogether.

Whenever I think about Wall St; about banks and Investors and the Federal Reserve, I always end up thinking about those ducks and how ultimately there's very little difference.

Last Thursday, Friday and this Tuesday the stock market saw triple digit gains on the expectation and demand that the Fed intervene and pump more liquidity into the markets. Didn't matter if the Fed used Greece or weak jobs or (fill in the rationale)--

So Bernanke provided the "Tuffy ducks" more 'bread'... they were pleased for a day and now realized they want more 'bread' than what was provided. They don't want little scraps of "Operation Twist" brand 'bread'.. They really want those large QE bread pieces fed to them.

And the 'ducks' (really they're rats) will make a big stink until its done.

~ "We're not going anywhere Cat.. Wakk Wakk.. Where's the bread?"

Today's actually a good day in the economy even though the financial media will portray it as doom and gloom. First, as of 3:30p, the Dow is down -230pts. We always celebrate a down day even if the reasons are as fake as eyelashes.

In addition, oil is trading under $80/barrel for the first time in many many months, which of course Investors hate. And the US dollar is gaining strength due to the Euro crisis, which Investors & Corporations Really Really Hate

But getting back to the duck/Investor comparison, what should be happening is the Fed, which holds the 'loaf of bread' under their arm, teach the banks and Investors a lesson in respect by doing absolutely nothing, and simply watch them desperately run in panic until they understand not to expect constant intervention and bailouts for the mess they created.

But like we've said often, the Federal Reserve is not a government agency. It is as private a business as Federal Express and its clients are the same banks and other financiers who manipulate the market to get their way. So expecting any change in policy is a pipe dream.

And expecting some other Fed Chair to come along and institute a different policy is a waste of time.

Most are unaware of this but when its time for the President to nominate a new Fed Chair, the list of choices is provided to him by the Fed. This is a big reason why so many Fed Chairs get re-nominated by Presidents of different political parties... the President looks at the list and thinks to himself, "What's the point?" and just re-nominates...

Here's another thing most do not understand.. there are two economies in America. The Wall St economy and the Real World economy. On occasion they blend to each other so success in corporate America "trickles down" to Main Street America but its rare.

If a Fortune 500 company's profits are up 25% or exporting more products abroad, it does not make your life any better unless you have investments with company X or work there, and even then your job isn't safe because you can always be fired as part of a 'restructuring'.

Most corporations don't create jobs anyways. They create positions.

What is the difference? Plenty. A position is an opening for a person to earn money in exchange for work provided. It can be minimum wage work, temp work, part-time work, etc.. Usually positions pay hourly wages and have little to no security.

Jobs are positions that pay a good wage; enough to allow someone to pay their bills and still have a little something left over. Jobs usually require education, provide benefits, allow the employee some rights and protections within the company and usually provide opportunities for future career advancement and/or promotion.

Eventually Wall St will have to do what its successfully avoided for 45 months now... basically, to take its lumps and accept Loss. As a nation, we've experienced 'panics', recessions and depressions'before... And Every time we've overcome it and been stronger economically...

In nature, life is about seasons. One can not have a springtime then eventual summer without a winter; it can not be held back indefinitely and the longer the attempt, the more foolhardy it will ultimately be... Eventually the finance world will be learning this.

Subscribe to:

Posts (Atom)